The past few years have been marked by great economic uncertainty. From Brexit to the continued trade war with China, and more recently the war in Ukraine, which has led to higher energy prices. This combination has led to the highest inflation levels since the 1980s – per the UK Office for National Statistics.

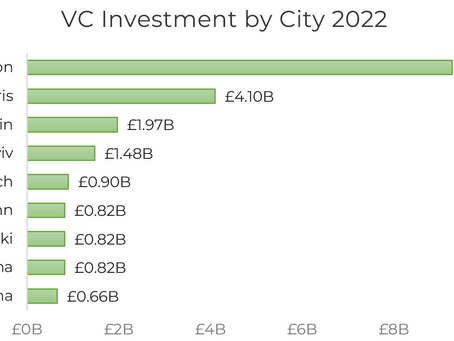

However, while this turbulence has caused many businesses to tighten their belts and put-off investment, it seems to have had the opposite effect on start-ups. In fact, a recent dealroom.co (a global provider of data and intelligence on start-ups and tech ecosystems) study showed that in the Q1 & Q2 of 2022 there was £12bil raised by VCs, with over 16% of that by first-time funds. This new “fresh capital” raised has never been as high in the “new-Palo Alto” (refer to next paragraph). According to Business and Innovation Magazine, over 950 UK-based start-ups and scale-ups have raised £12.4 billion in 2022 (YTD) compared to £12 billion for the entire of 2020. Bristol and Oxford collectively raised c. £490 million in capital, which is similar to the amount raised by both Hamburg and Athens jointly.

The new Palo Alto (referred to earlier) is a term used by organisations such as dealroom.co to describe 4 main economic, tech, innovation, and start-up hubs, namely: Belgium, France, Holland, and the UK. The new Palo Alto eco-system has a myriad of unique features, differentiating the region from the US.

How is market and economic turbulence affecting investor confidence in start-ups in the new Palo Alto?

It is widely believed that economic turbulence negatively impacts start-ups. However, there is evidence to suggest that this is not always the case. In fact, in some instances, economic turbulence can provide an opportunity for start-ups to thrive.

Dealroom.co‘s data has shown that in the new Palo Alto, investment has more than doubled compared to the same period in the previous year (Q1 – Q2 2021 – Q1 -Q2 2022), and more than tripled pre-covid levels. Consider the below illustration from Dealroom.co.

Currently, the new Palo Alto accounts for nearly 60% of VC capital investment, and over 32% for institutional/corporate investors, across Europe.

Why are start-ups a good investment strategy during turbulent and high inflationary periods?

Businesses and consumers are typically more interested in products that either cut costs or increase efficiency – this is exacerbated during tough economic times. Many start-ups create products and services that solve these problems and are usually part of a start-up’s value proposition.

As we saw in 2008 / 2009 credit crunch, there has been an explosion of new start-ups. Find below some of the famous brands that were founded during 2008 / 2009 recession.

What is the reason for this explosion in activity by start-up founders?

Fundable, one of the biggest marketplaces for start-up capital in the US, has identified that startups that have successful funding rounds successful are raised through products that solve problems.

Today, with high inflation and high costs, start-up teams are under more pressure to provide solutions to problems and address these problems in a cheaper and/or efficient way. Start-ups are known to be more flexible than non-start-ups. These start-ups find it easier to make “course corrections” and adapt to uncertainty.

Eric Reis in his book The Lean Start-Upexplains how start-ups are geared to run under extreme uncertainty. This is one of the many reasons why start-ups’ can grow their revenue significantly faster than inflation – making start-ups exciting as an inflationary hedged investment.